Why Invest in Gold?

Gold has long been considered a safe haven asset, offering stability and security in times of economic uncertainty. But why should you consider investing in gold today? For first-time investors, this question is more relevant than ever.

At Gold Reserve, we believe gold is one of the smartest and most reliable investment choices available. Events like the 2008 financial crisis and the more recent Covid-19 pandemic have eroded trust in the banking system, leaving many searching for safer ways to protect their money. With increasing geopolitical tensions, rising inflation, and national debt at unprecedented levels, gold remains a tried-and-tested solution for preserving wealth. So, why invest in gold now? The reasons are clear.

Here’s why gold deserves a place in your investment portfolio.

Gold: The Ultimate Insurance

In a world of economic turbulence, owning physical gold provides unmatched financial security. Gold has maintained its value for centuries, serving as a hedge against inflation, deflation, currency instability, and stock market volatility. Unlike paper currencies, which governments can devalue through excessive money printing, gold’s intrinsic value remains intact. This truly encapsulates why investing in gold is seen as the ultimate insurance.

Key benefits of gold ownership:

- Resilience during economic crises: Gold tends to thrive when traditional assets like stocks and property underperform.

- Global recognition: As a universally valued precious metal, gold can be traded or sold anywhere in the world. Considering global benefits answers why many invest in gold.

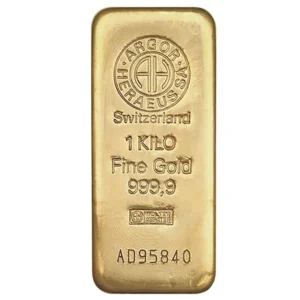

- Portability: Gold bars and coins are compact, making them easy to store or transport.

In extreme scenarios, such as banking collapses or hyperinflation, small denominations of gold coins can even serve as a medium of exchange.

Protect Your Wealth with Gold

Since the 2008 financial crisis, individuals have become increasingly aware of the need to safeguard their wealth. Gold offers a dependable, long-term solution for preserving purchasing power, even in times of uncertainty. While other investments may fluctuate or lose value, gold’s enduring appeal ensures it remains a low-risk asset. When considering why to invest in gold, protection against market volatility is paramount.

Unlike speculative investments, gold should be viewed as a secure, long-term addition to your portfolio. By holding gold, you diversify your assets and protect yourself against potential downturns in stocks, real estate, and currencies.

Physical Gold: Take Control of Your Wealth

When you invest in physical gold—whether in bars or coins—you gain full control over your financial future. Unlike electronic assets like ETFs or stocks, owning tangible gold eliminates reliance on fund managers, brokers, or banks. Storing gold securely at home or in a vault ensures that you alone have access to your wealth. Thus, investing in gold allows full control over your assets.

Physical gold also offers flexibility. Its liquidity means you can quickly sell to gold dealers worldwide, often receiving cash or bank transfers within minutes.

Gold’s Historical Performance and Future Outlook

Gold’s value has proven resilient over time, often increasing during periods of financial instability. For example:

- After the 2008 crisis, gold prices surged, doubling between 2007 and 2011.

- The uncertainty of Brexit and the U.S.-China trade wars drove gold prices higher in 2016 and 2017.

- In 2020, the Covid-19 pandemic saw gold prices reach all-time highs, as central banks flooded economies with fiscal stimulus.

Even in 2022, gold demonstrated its strength as inflation skyrocketed and geopolitical tensions escalated, notably with Russia’s invasion of Ukraine. Experts predict that as inflation and uncertainty persist, gold will continue to perform well as a reliable store of value. For those asking why invest in gold, historical performance is a key indicator.

Growing Global Demand for Gold

Demand for gold has reached record levels in recent years, driven by central banks, consumers, and industries alike. Countries like China and India, known for their strong cultural affinity for gold, are seeing unprecedented investment levels. In Europe, nations like Germany, Turkey, and Switzerland have also experienced surging demand. Observing global trends helps one understand why gold is a crucial investment.

Gold’s industrial applications further add to its value. From smartphones to electric vehicles and solar panels, the demand for gold in cutting-edge technologies ensures its relevance in the modern economy.

Why Now Is the Best Time to Buy Gold

With central banks increasing their reserves and global demand at an all-time high, there’s never been a better time to invest in gold. Don’t be deterred by the misconception that gold is only for the wealthy. Gold investments are accessible to everyone, with entry-level options available at prices as low as €30. The timing of your investment often answers why invest in gold today.

Financial experts recommend allocating 5-10% of your liquid assets to gold as a safeguard against economic instability. Whether you’re building a nest egg or managing a multi-million-euro portfolio, gold acts as the ultimate hedge against unpredictable markets.

Conclusion: Gold as a Foundation of Financial Security

Gold is more than just an investment; it’s a way to protect your financial future. In an era of rising inflation, political instability, and economic volatility, gold stands out as a safe, reliable, and universally valued asset. And this is precisely why gold investment should be a foundation of your financial security.

Take control of your wealth today by adding physical gold to your portfolio. Whether you’re looking for coins or bars, Gold Reserve offers a wide range of investment options tailored to suit your needs. Start small or invest big—either way, gold is your partner in building long-term financial security.

Explore our collection of investment-grade gold and make your purchase today. Protect your wealth, diversify your assets, and gain peace of mind with gold.

Use these links to explore the sections of the Investment Guide:

- How to Buy Gold

- Gold Bars or Gold Coins?

- Gold or Silver?

- Gold Silver Ratio Explained

- Best Time to Buy Gold?

- Is Gold a Good Investment?

- Is Scrap Gold Worth Buying?

- Why Buy Physical Gold?

- Where to Buy Gold?

- Why Buy from Gold Reserve?

- Top 10 Gold Producers

- Top 10 Gold Reserves

- 2025 Gold Price Forecast

- Is the Sale of Investment Gold Taxable in Bulgaria?

- Precious Metals Glossary