How to Buy Gold

The Ultimate Guide to Precious Metal Investments

How to Buy Gold and Silver is important topic for centuries, astute investors have recognized the importance of including gold in a well-balanced portfolio. Gold, along with silver, not only provides wealth diversification but also serves as a globally renowned safe haven, offering ultimate insurance and protection during turbulent economic times.

History demonstrates that gold is a timeless asset, consistently preserving wealth. High gold prices and record demand have ensured it outperforms most other investments.

In the wake of the 2008 financial crisis, the world faces unprecedented economic uncertainty again due to the global Covid-19 pandemic. Central banks’ responses have led to unprecedented money-printing, with national debts reaching peacetime records and creating new inflation risks.

Gold reached a new all-time high in August 2020. Despite a pullback, it remains high due to investor demand. Low interest rates and inflation support potential further gains, possibly surpassing 2020’s record.

Additionally, the fallout from Brexit, the US-China trade war, deteriorating Middle East relations, and climate change present major economic challenges. Gold remains a vital safe haven and a valuable addition to any diverse portfolio. Silver, too, offers similar benefits, making it a worthy consideration for investors looking to diversify their precious metal investments.

How to Buy Gold and Silver?

This guide is essential reading for all investors. If you’re new to gold investment, we’ll explain how to get started. Even seasoned investors will find valuable information and advice on investing in gold coins and bars, including the reasons to buy gold and where to purchase it.

The guide also explores the differences between bars and coins, gold versus silver, and the benefits of owning physical gold over paper and electronic gold, among other topics.

Read more about bars vs coins, gold vs silver, the benefits of owning physical gold

over paper and electronic gold, and much more.

Why Invest in Gold and Silver?

To determine if gold is a good investment, it’s crucial to understand why people buy it. During times of economic uncertainty and instability, gold often makes more sense than other assets. With confidence in the banking system and global economy at an all-time low, gold bullion can serve as the ultimate insurance and should be a key part of any investment portfolio.

The demand for gold is higher than ever, and there are many reasons to buy it. Owning gold can be the best way to preserve your wealth and potentially earn a healthy return in these uncertain times. It’s an age-old question: where is my money really safe? Increasingly, people are turning to the oldest answer: GOLD. Silver also offers similar benefits, making it a valuable addition to your investment strategy.

Read about the real benefits of investing in gold.

Why Invest in Physical Gold? Physical Gold vs. ETFs

As the saying goes, “If you don’t hold it, you don’t own it.” There are numerous benefits to physically holding gold rather than investing in electronic gold (ETFs) or paper gold. In these unpredictable economic times marked by banking instability, low interest rates, underperforming currency markets, volatile stocks, and repeated rounds of money printing, gold offers a reliable safeguard against turbulence.

However, not just any form of gold will do—physical gold is a timeless asset that always retains value and stands the test of time. Holding physical gold bars or coins provides ultimate control and insurance for your wealth against financial crises in an underperforming economy.

Where to Buy Gold?

Research is crucial. Your decision to buy gold online should be well-informed and backed by thorough research. The same applies when selecting your bullion dealer. The internet is an excellent resource for conducting this research, offering access to the impartial experiences, opinions, and recommendations of millions worldwide. Start by typing the bullion dealer’s brand name into Google. The internet serves as the world’s largest open forum, where companies have no control over public opinion. If a bullion dealer has a negative online reputation, it will quickly become apparent, and they should be avoided at all costs.

You can browse our categories

Gold Bars | Gold Coins | Silver

When to Invest in Gold and Silver?

Reflecting on historical data, it’s clear that 2005/06 was an excellent time to buy gold bullion, Similarly, the 2007/08 crisis presented another prime opportunity, with gold price ssurges. Today, common questions include: Is it too late to buy gold? How much longer can gold prices rise?

While there’s no exact science to timing gold investments, many successful investors rely on effective, timeless techniques and indicators to guide their decisions.

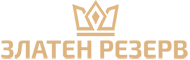

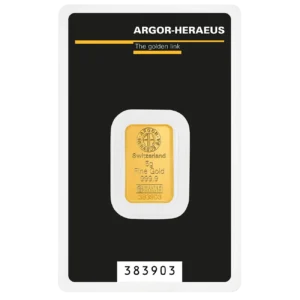

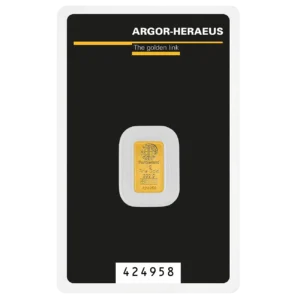

Gold Bars vs. Gold Coins?

Whether you’re new to bullion investment or not, deciding between bullion bars and bullion coins requires careful consideration. Conducting thorough research is advisable, as there is no definitive right or wrong choice—it depends on individual needs and circumstances. Key factors to consider include the value of your investment, product premiums, how long you plan to hold your gold, storage options, taxation, and how you plan to realize the value of your investment.

Silver also offers similar investment opportunities and should be considered alongside gold for a diversified precious metals portfolio.

Should I Invest in Gold and Silver?

Many investors debate whether to invest in gold or silver, but the savviest investors choose both. Gold offers ultimate insurance and protection during uncertain economic times, while silver is a more speculative investment. Although both are popular precious metals, silver can yield substantial profits despite the initial VAT outlay. Owning both gold and silver can be highly beneficial due to their differing investment characteristics.

Is Bullion Subject to VAT?

The good news is that investment-grade gold is VAT-free, including all the gold bullion bars and coins available on our website. However, unlike gold, silver is subject to VAT, making it a more long-term, speculative investment. Due to the volatile nature of silver prices, returns can often be realized quickly. If you are VAT registered and believe you may be able to reclaim your VAT, we recommend consulting your accountant.

Where Should I Store My Gold and Silver?

One of the main benefits of investing in physical gold and silver bullion bars and coins is having direct control over your assets. However, deciding where to store your bullion is crucial. There is no single correct answer; it ultimately depends on personal preference. Storing gold and silver bullion is a practice that has been successfully carried out for centuries, particularly in countries like Germany and India.

Generally, there are four primary storage options: allocated storage, a bank safety deposit box, a home safe, or a more creative solution.

Why Buy Gold and Silver Online at Gold Reserve Ltd?

Gold Reserve Ltd is Bulgaria’s largest and most trusted online bullion dealer, dispatching hundreds of parcels with free, fully insured next-day delivery every month. As a licensed dealer, Gold Reserve Ltd ensures a secure and reliable service.

How to Buy Gold and Silver Online at Gold Reserve

Buying gold and silver online at Gold Reserve is quick, simple, and secure. You can create and register your account online in just two minutes. Once your account is set up, you can purchase gold and silver bullion online 24/7 with just a click. Your online account allows you to track the performance of your investments against current market prices, access the latest product news, and securely store your invoices. With a comprehensive range of gold and silver bullion products available at low margins, buying gold and silver online has never been safer or easier.

Use these links to explore the sections of the Investment Guide:

- Gold Bars or Gold Coins?

- Gold or Silver?

- Gold Silver Ratio Explained

- Best Time to Buy Gold?

- Is Gold a Good Investment?

- Why Invest in Gold?

- Is Scrap Gold Worth Buying?

- Why Buy Physical Gold?

- Where to Buy Gold?

- Why Buy from Gold Reserve?

- Top 10 Gold Producers

- Top 10 Gold Reserves

- 2025 Gold Price Forecast

- Is the Sale of Investment Gold Taxable in Bulgaria?

- Precious Metals Glossary